Global Apparel Trade Update Sep 24 and our quarterly report, Wazir Textile and Apparel Index for Q1 FY25.

The latest import data and macro numbers indicate early signs of demand revival in key markets. Key highlights from monthly report are:

- Apparel Imports (in July 2024):

- US: US$ 8 bn, up 8% YoY

- EU: US$ 8.1 bn, up 5% YoY

- UK: US$ 1.6 bn, up 7% YoY

- Japan: US$ 2.2 bn, up 16% YoY

- Apparel Retail Scenario:

- US apparel store sales in August 2024 are estimated to be 1% lower than August 2023 and home furnishing store sales are estimated to be 8% higher UK apparel store sales in August 2024 were ã 3.6 bn., which is same as in August 2023

- In August 2024, the US recorded its lowest inflation rate since February 2021 at 2.5%. The unemployment rate decreased by 0.1%, after peaking in July at 4.3% since December 2021. Also, the Consumer Confidence Index rose by 3% and with the recent announcement by the US Federal Reserve to cut interest rates, a positive macroeconomic trend may be expected in coming months.

- India’s apparel exports in August 2024 were US$ 1.3 bn., which is 18% higher than in August 2023. Total Indian apparel exports are expected to reach US$ 15 billion in 2024, marking a 5-7% increase compared to 2023.

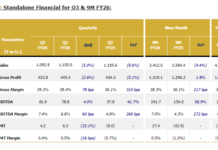

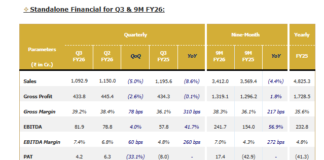

Wazir textile and apparel index also registered improvement. With a steady rise in demand and improved market sentiment, the financial performance of Indian textile and apparel companies saw notable growth in the last quarter. According to our quarterly report, compared to Q1 FY24, Q1 FY25 showed an 11% increase in WTI sales and a 29% rise in WTI EBITDA. Meanwhile, WAI sales grew by 19%, and WAI EBITDA saw a 13% increase.