In a very challenging economic environment, Rieter succeeded in significantly increasing sales and expects a positive EBIT margin for the 2022 financial year.

For Rieter, in addition to the geopolitical uncertainties, the 2022 financial year was characterized by three main challenges:

Due to the rapid rise in inflation, the exceptionally high order backlog of around CHF 1 840 million at the beginning of 2022 was processed at significantly higher costs. It was only possible to offset these higher costs in part by means of price increases and other remedial measures.

In order to safeguard deliveries, it was necessary to compensate for serious material bottlenecks, particularly in electronic components, which resulted in considerable additional development expenditure.

Major expenses were also incurred in connection with the acquired businesses (Accotex, Temco and Winder).

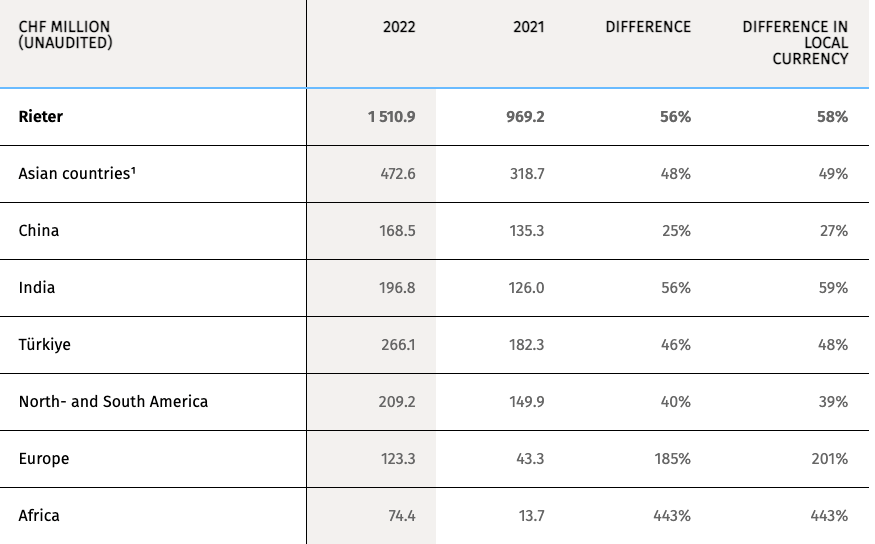

Sales

The realization of sales from the exceptionally high order backlog developed better than expected. With sales of CHF 1 510.9 million, Rieter achieved an increase of 56% compared with the previous year (2021: CHF 969.2 million). In the second half of 2022, especially in the fourth quarter, the measures introduced to address material bottlenecks had a positive impact. Consequently, sales increased to CHF 890.3 million compared with the first six months (first half-year 2022: CHF 620.6 million).

EBIT margin

The trend in the EBIT margin was strongly influenced by substantial cost increases, which could only be offset in part through price increases and other remedial measures. In addition, to compensate for material shortages, expenses were incurred in connection with the development of alternative solutions and the acquired businesses.

Rieter succeeded in improving profitability compared with the first half of 2022 due to the higher sales volume and offsetting measures to compensate for increased costs, and expects a positive EBIT margin of around 2% for the full year 2022 (2021: 4.9%).

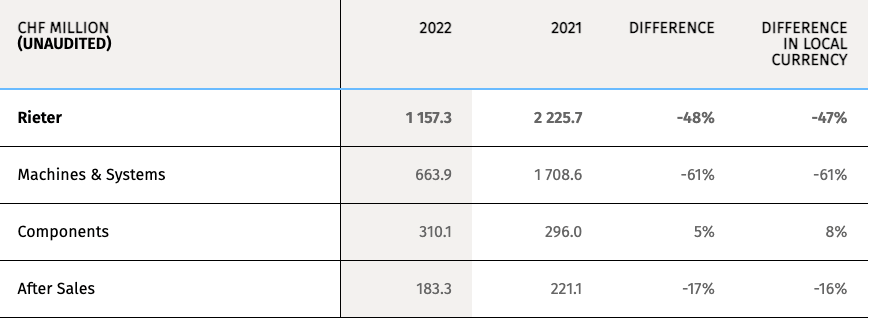

Order intake

In line with expectations, the order intake of CHF 1 157.3 million in 2022 was below the record year of 2021 (CHF 2 225.7 million). The market situation is characterized by investment restraint due to geopolitical uncertainties, higher financing costs and consumer reticence in important markets.

Order backlog

The company had an order backlog of around CHF 1 540 million at the end of 2022, which thus extends well into 2023 and 2024. In 2022, Rieter recorded order cancellations of less than 10% of the order backlog of CHF 1 840 million at the beginning of the year.

Preparations for ITMA 2023 on schedule

Rieter has continued to boost its innovative capability and, in order to further extend its technology leadership, will present new innovative solutions at ITMA 2023 in Milan.

Action plan to increase sales and profitability

Implementation of the action plan to increase sales and profitability is ongoing. With regard to the profitability of the order backlog, which remains high, the implemented price increases in combination with a favorable trend in costs, particularly in logistics, are having an impact. In addition, progress was made in eliminating material bottlenecks and reducing expenses for the three acquired businesses.

Rieter site sales process

The sales process for the remaining land at the Rieter site in Winterthur (Switzerland) is proceeding according to plan. In total, around 75 000 m2 of land will be sold. The Rieter CAMPUS is not part of this transaction.

Results press conference 2023

Rieter will provide further details on the 2022 financial year and an outlook for the 2023 financial year on March 9, 2023. In addition, the full 2022 Annual Report will be published, and a press conference will be held.

Annual General Meeting of April 20, 2023

The next Annual General Meeting of Rieter Holding AG will take place on Thursday, April 20, 2023. Proposals regarding the agenda must be submitted in writing, accompanied by information concerning the relevant motions and evidence of the necessary shareholdings (with a par value of CHF 0.5 million as stipulated by Article 9 of the Articles of Association), by no later than February 17, 2023, to Rieter Holding Ltd., Office of the Company Secretary, Klosterstrasse 32, CH-8406 Winterthur, Switzerland.

Order Intake by Business Group

Sales by Business Group

Sales by Region