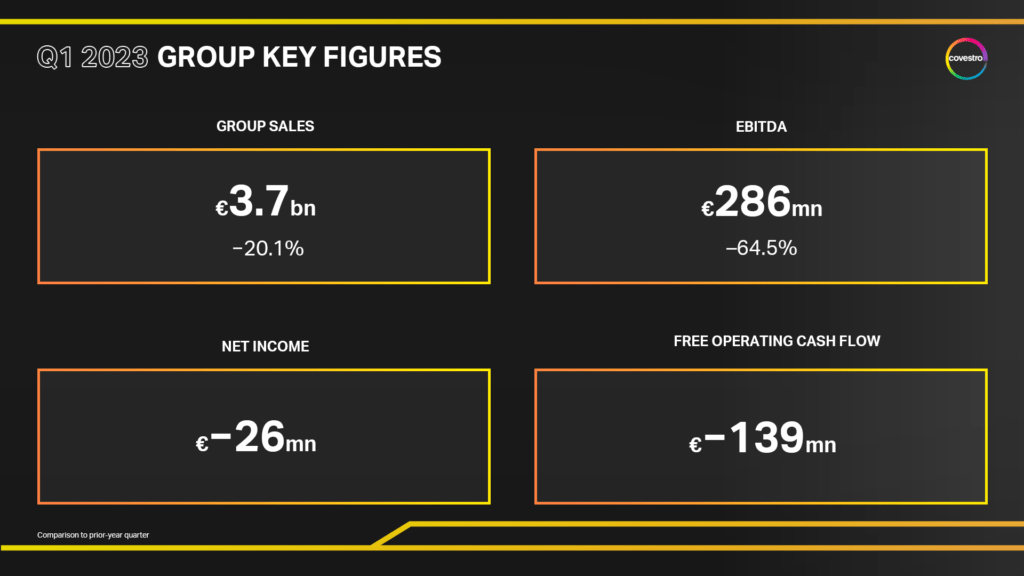

Covestro got off to a better start than expected in the 2023 fiscal year. Despite a still weak level of demand in a business environment that remains challenging, the company was able to limit the related negative impacts. Group sales were down 20.1% in the first quarter of 2023, to EUR 3.7 billion (previous year: EUR 4.7 billion), among other things due to a drop in volumes sold and a lower selling price level. The Group’s EBITDA amounted to EUR 286 million and was thus 64.5 percent lower year over year (previous year: EUR 806 million) due to a drop in volumes sold and lower margins. However, this result significantly exceeded the company’s own expectations of EUR 100 million to EUR 150 million as well as recent analysts’ estimates of EUR 158 million for the first quarter. That was due in particular to the Group’s focus on efficiency as part of its Sustainable Future strategy. Net income in the first quarter fell to EUR –26 million (previous year: EUR 416 million), while the free operating cash flow (FOCF) was EUR –139 million (previous year: EUR 17 million).

“Our start to 2023 has been better than expected and clearly shows that our Sustainable Future strategy is having an impact. We have achieved an initial success through our own efforts,” says Dr. Markus Steilemann, CEO of Covestro. “This positive momentum shows that Covestro is on the right track. We continue to focus relentlessly on sustainable growth, successful cooperation with our customers and efficiency. In this way, we are pushing ahead with our vision of becoming fully circular.”

Photo – Covestro

Guidance for 2023 quantified

In view of the results for the first quarter of 2023, higher margins and an improved cost level, Covestro has adjusted the guidance for the key management indicators EBITDA, free operating cash flow, and ROCE above WACC for fiscal 2023. Reductions of emissions expected in energy procurement have led to the guidance for greenhouse gas (GHG) emissions being narrowed.

Covestro now projects that the Group’s EBITDA will be between EUR 1.1 billion and EUR 1.6 billion (previously: significantly down on the previous year). The Group anticipates free operating cash flow of between EUR 0 million and EUR 500 million (previously: significantly down on the previous year) and ROCE above WACC of between –6.0 percentage points and –2.0 percentage points (previously: significantly down on the previous year). Covestro’s GHG emissions measured as CO2 equivalents are now projected to be between 4.2 million metric tons and 4.8 million metric tons (previously: on a level with the previous year*). For the second quarter of 2023 Covestro expects EBITDA of between EUR 330 million and EUR 430 million.

“The first quarter of 2023 went much better than expected at the beginning of the year, and we’re also confident about the current second quarter. That’s reflected in our guidance,” says Dr. Thomas Toepfer, CFO of Covestro. “Against the backdrop of reduced costs and the increased margin level, we also see positive momentum for the further course of the year and have adjusted our guidance for fiscal 2023. In addition, we have decided to resume our current share buyback program in the short term.”

Covestro had started the share buyback program in February 2022 and temporarily paused it in the middle of last year due to the weakening economic outlook. In view of the revised guidance and the sequential improvement in earnings and volumes, the Board of Management has now decided to continue the current program. The buyback of the next sub-tranche with a volume of up to EUR 75 million will begin in May 2023.

Focus still on sustainable growth and circular economy

Covestro is consistently implementing its strategy “Sustainable Future” and made further progress in its efforts to become fully circular and develop sustainable innovations in the first quarter of 2023. In addition to investing in its own research and development of non-fossil raw materials, Covestro is also focusing on the use of mass-balanced products, for example. As part of that, the Group is having more and more of its global sites certified under the internationally recognized ISCC PLUS sustainability standard and is thus continuously expanding its circular product portfolio. In March 2023, Covestro was awarded certification for Baytown, Texas (United States), its third-largest production site worldwide, meaning that all its central locations have now been certified in accordance with this standard. Alongside Baytown, they include Leverkusen, Dormagen and Krefeld-Uerdingen (Germany), Shanghai (China), Changhua (Taiwan), Map Ta Phut (Thailand), Antwerp (Belgium) and Filago (Italy). Covestro expects to start delivering selected ISCC PLUS-certified products from its Baytown plant in the second half of 2023.

Covestro is also making continuous progress in the field of plastic recycling. Together with its partners, Covestro successfully completed PUReSmart, an EU-funded research project, proving that chemical recycling of flexible PU foam, such as is used in mattresses, is possible. Now Covestro, together with partners from the waste management industry, is driving the further development of this technology through to industrial use. Covestro has now launched Evocycle® CQ Mattress, the first initiative dedicated to chemolysis of PU mattress foam, thus underscoring the company’s willingness to continue investing in this innovative technology.

Photo – Covestro

Both segments robustly positioned despite challenges

As the results for the first quarter of 2023 demonstrate, Covestro is well positioned with its strategic and structural setup to successfully overcome challenges on its own. While the Performance Materials segment focuses on the reliable supply of standard products at competitive market prices, the Solutions & Specialties segment serves the need for complex products with a high pace of innovation in combination with application technology services. Covestro can thus leverage the individual strengths of both segments in their respective competitive landscapes ideally and gear them to customers’ needs.

Group sales in the Performance Materials segment fell by 25.0 percent to EUR 1.8 billion (previous year: EUR 2.4 billion). That was attributable in particular to the decline in volumes sold and lower average selling prices, mainly as a result of continued weak demand. The segment’s EBITDA declined by 72.1 percent year over year to EUR 173 million (previous year: EUR 620 million) due to lower margins and a reduction in volumes sold driven by demand and availability factors. The free operating cash flow declined to EUR –57 million (previous year: EUR 112 million), primarily as a result of the drop in EBITDA.

Sales in the Solutions & Specialties segment fell by 15.3 percent to EUR 1.9 billion (previous year: EUR 2.2 billion), mainly on the back of a decline in volumes sold and lower average selling prices, both due to weaker demand. The segment’s EBITDA fell in the first quarter by 26.3 percent year over year to EUR 165 million (previous year: EUR 224 million). Here, too, the main drivers behind this decline were the demand-related decrease in volumes sold. However, the rise in margins had a positive effect as lower raw material prices outweighed the lower selling prices. The free operating cash flow increased by 67.1 percent to EUR –48 million (previous year: EUR –146 million), mainly because of the fact that less cash was tied up in working capital compared to in the same quarter of the previous year.