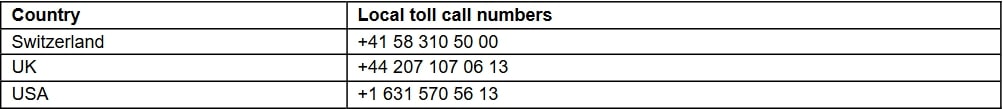

- Updating 2024 guidance: Expect operational EBITDA margin of ~16% (previously: 15.5%-16.0%) supported by continued strong execution and despite softening PMIs that impacted sales. Organic sales expected to decrease by high single-digit to low-teens percentage at constant FX (previously: high single-digit percentage decrease).Stable operational Group EBITDA margin attributed to both divisions, driven by strong focus on pricing, cost actions and efficiency, while facing challenging end markets.

- Group order intake decreased by 4% year-over-year at constant FX, driven by transitory softening of end markets in Surface Solutions. Polymer Processing Solutions orders continued to stabilize in the third quarter year-over-year.

- Group sales down 5% year-over-year at constant FX due to 2023 order postponements in Polymer Processing Solutions. Surface Solutions delivered stable sales (-1% at constant FX) despite sluggish market conditions.

- Updating 2024 guidance: Expect operational EBITDA margin of ~16% (previously: 15.5%-16.0%) supported by continued strong execution and despite softening PMIs that impacted sales. Organic sales expected to decrease by high single-digit to low-teens percentage at constant FX (previously: high single-digit percentage decrease).

Group Key Figures as of September 30, 2024 (CHF million)

Michael Suess, Executive Chairman of Oerlikon, stated:

“In the third quarter, we achieved robust profitability, driven by our strong focus on execution quality in challenging end markets. Surface Solutions’ resilience, supported by innovation and diversification started a decade ago, positions us strongly to benefit when markets recover. Polymer Processing Solutions still faces challenges in its end markets, yet succeeded in delivering a strong 13% EBITDA margin, which was well above the levels during the last downcycle. Our pure play strategy implementation is on track. We have initiated actions to merge our headquarters organization with that of Surface Solutions, and these changes will be implemented from January 2025 onwards. In addition, our manmade fibers business will be set-up as an independent organization ready for separation. As we evaluate different options, our goal remains to create maximum value for all stakeholders.”

Separation of Oerlikon’s Manmade Fibers Business on Track

As announced in February 2024, the planned separation of Oerlikon’s manmade fibers business over 12-36 months and the implementation of Oerlikon’s pure play strategy focusing on surface solutions are well on track. As a next step, the manmade fibers business will be set-up as a largely independent organization ready for the planned separation.

In preparation for the separation, Oerlikon is reducing its support functions, as it will no longer require all of the Group’s current resources. Accordingly, streamlining has been initiated, merging headquarters’ functions with those from Surface Solutions. Oerlikon has introduced a retention plan to ensure business continuity and retain talents. The streamlining will result in an agile and lean organization, while allowing Oerlikon to adjust its costs base to reflect the future revenue of the company.

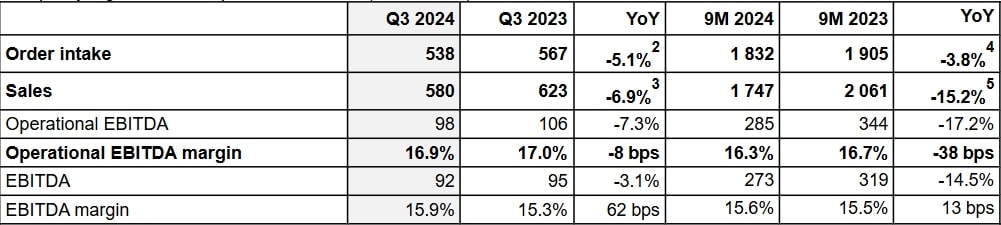

Surface Solutions Division with Stable Sales and Improved Profitability

Surface Solutions delivered stable sales (-1% year-over-year) at constant exchange rates despite declining end markets. Resilience was supported by continued innovation and a robust performance in general industries, energy and aviation. Order intake decreased by 5% year-over-year at constant exchange rates. This was driven by slowing markets in the third quarter, as indicated by contracting purchasing managers indices (PMIs) worldwide.

Operational EBITDA margin improved 45 basis points to 18.0% in Q3, supported by pricing, efficiency and innovation.

Key figures as of September 30, 2024 (CHF million)

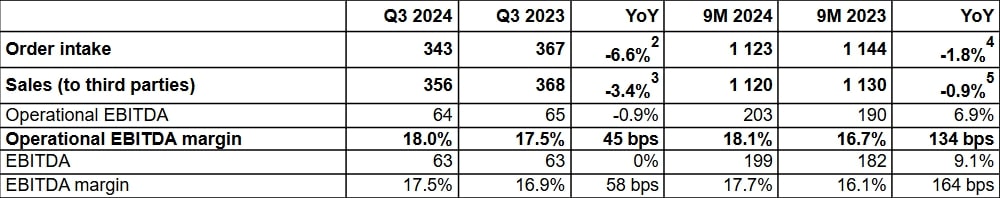

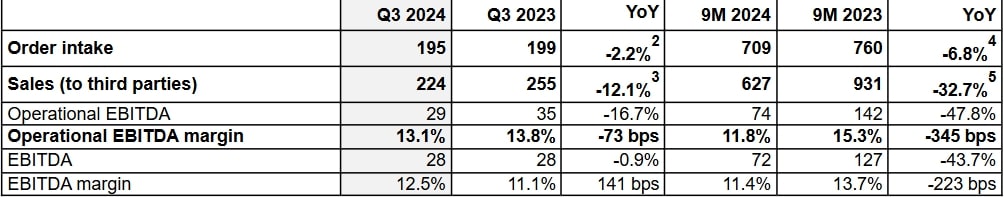

Polymer Processing Solutions Division with Stabilizing Orders and Robust Profitability

Polymer Processing Solutions order intake continued to stabilize (-2%) year-over-year, while sales at constant currency declined by 11%, reflecting postponement of orders in 2023. The division continued to see positive momentum in small- and mid-sized filament orders. Sluggish industrial production, as indicated in PMIs, impacted the non-filament business, where Q3 orders have decreased to 2016 trough levels.

The division achieved a robust operational EBITDA margin of 13.1% despite lower sales volume. The margin was supported by proactive cost actions, counteracting operating leverage and limited pass-through of higher input costs to maintain volume.

Key figures as of September 30, 2024 (CHF million)

Additional Information

To participate in the results’ conference call today at 10:30 CET, please click on this link to join the webcast. To ask questions in the Q&A session, please dial in.